Gold Prices Surge to 3-Month High as Global Uncertainty Fuels Safe-Haven Demand

June 10, 2024 – The spot price of gold reached $2,350 per ounce this week, marking its highest level since March 2024, as investors flock to the precious metal amid mounting economic instability. Analysts attribute this 9.2% quarterly price surge to a “perfect storm” of geopolitical tensions, currency fluctuations, and shifting central bank policies.

Key Drivers Behind the Rally

1. Federal Reserve Rate Cut Speculation

With weaker-than-expected U.S. jobs data and cooling inflation, markets now price in:

- 87% probability of September Fed rate cut (CME FedWatch)

- Potential 50 basis point reduction by year-end

“Gold’s inverse relationship with the dollar makes it the prime beneficiary of dovish monetary policy,” notes Standard Bank commodities analyst Sarah Kiggundu.

2. Escalating Geopolitical Risks

- Renewed Middle East tensions

- Ongoing Russia-Ukraine conflict

- U.S.-China trade war resurgence

3. Central Bank Buying Spree

Q2 2024 saw record official sector demand:

- Turkey +45 tonnes

- China +38 tonnes (16th consecutive month of buying)

- Uganda +5 tonnes (BoU diversification strategy)

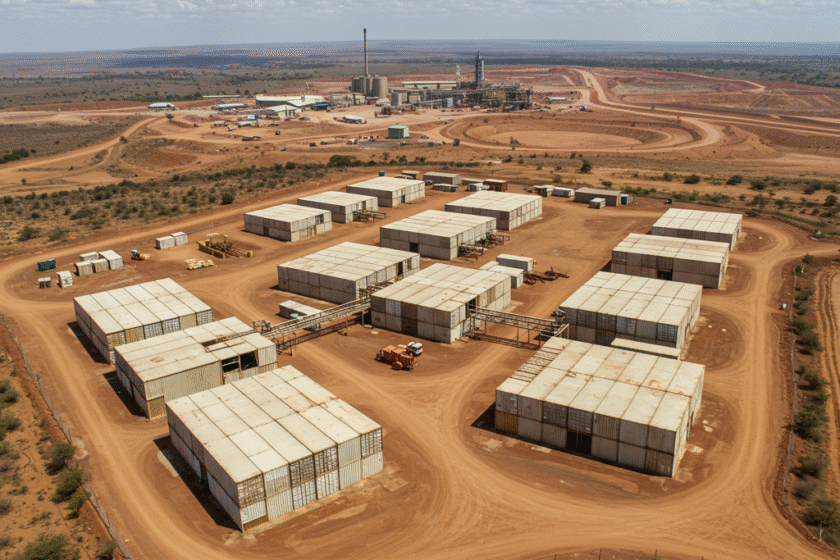

Uganda’s Competitive Position

While global prices soar, Uganda’s gold remains attractively priced at:

🏷️ 2,100−2,100−2,250/oz FOB Entebbe

*(15-20% discount to COMEX futures)*

This pricing advantage stems from:

✔ Lower production costs ($900/oz all-in sustaining cost)

✔ Government export incentives

✔ Proximity to Dubai/India markets

Investor Implications

For Physical Gold Buyers:

- Stockpile before seasonal Q3 price hikes

- Lock in contracts during current price consolidation

- Utilize Uganda’s VAT-free export regime

For Mining Investors:

- Margins expanding to 60-65% (vs. 52% in Q1)

- Faster ROI on new projects

- Improved financing terms from bullion-backed lenders

Great Rock Limited’s Market Response

To capitalize on these conditions, we’re:

🚛 Increasing weekly allocations to 50kg for qualified buyers

📈 Offering fixed-price 3-month contracts at 5% below spot

🛡️ Introducing price-risk insurance through Lloyds syndicate

“This isn’t just a short-term spike,” asserts Great Rock COO Miriam Nalwoga. “Structural deficits in mine supply and sustained central bank demand create a multi-year bull case.”

Price Outlook (Q3-Q4 2024)

| Institution | Forecast | Rationale |

| Goldman Sachs | $2,450 | ETF inflows resurgence |

| World Bank | $2,300 | Moderation after Q2 surge |

| Uganda Miners Assoc. | $2,380 | Persistent Asian demand |

How to Position Your Portfolio

1️⃣ Diversify with Uganda’s low-premium gold

2️⃣ Consider royalty streams from producing mines

3️⃣ Hedge currency risk with gold-linked UGX instruments

Act Now:

📞 +256 XXX XXX XXX

📧 trading@greatrocklimited.com

Disclaimer:

Prices valid as of 10/06/2024. Past performance ≠ future results.

This is a useful post for finding broken links within the website, what about links pointing outwards that are broken? I can use a free web service but wondered if this was possible.

Great tool! I am using a redirect plugin to send all my 404’s to my home page but I think it’s slacking sometimes.